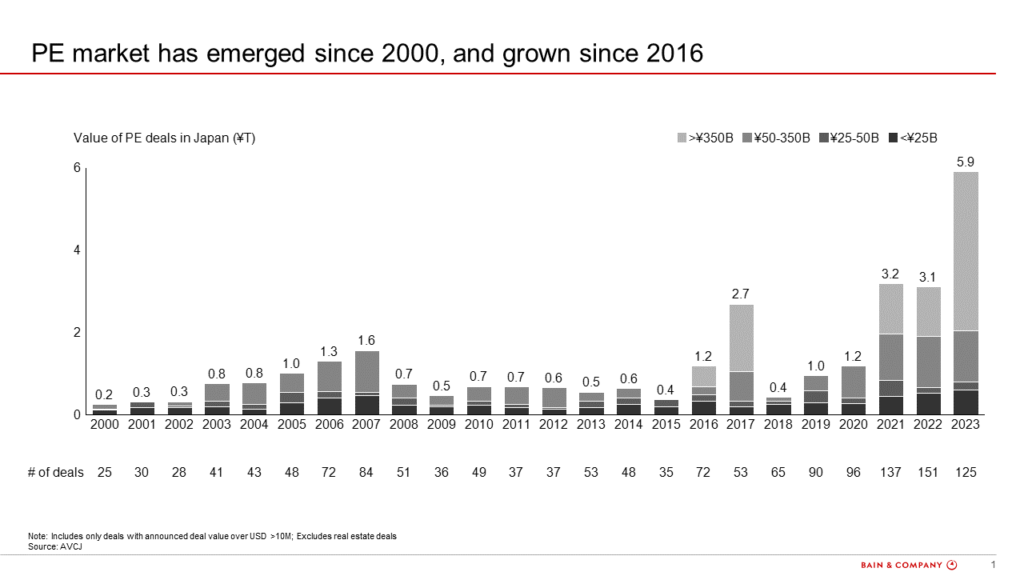

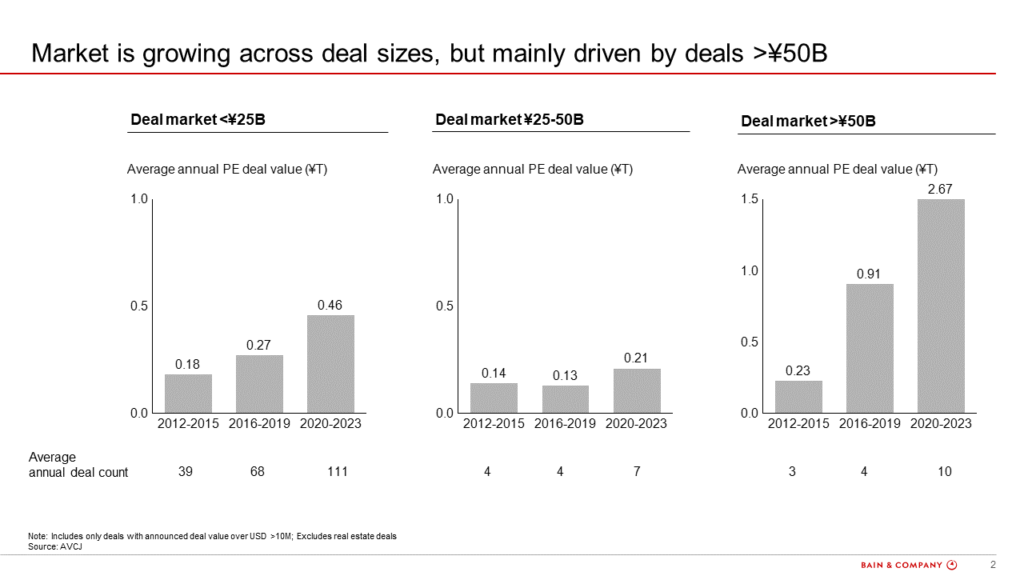

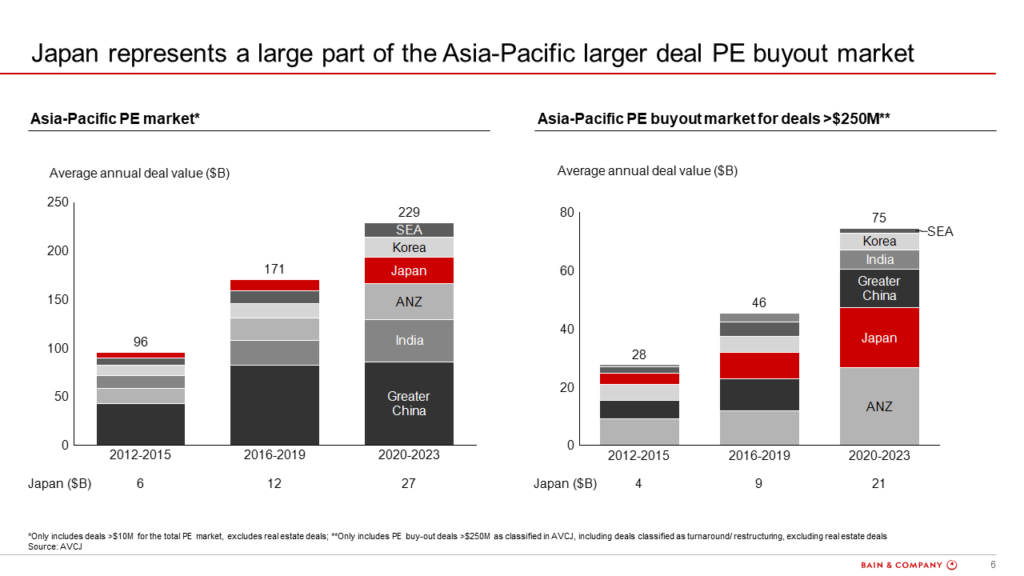

Japanese PE market is now greater than $20B in deal value per year and has experienced a growing trajectory over the last 5 years, mainly driven by an increase in the volume of larger deals. However, it is still relatively small compared to other developed markets such as the US or Germany. Most deals are buy-outs, and occur in virtually all industries.

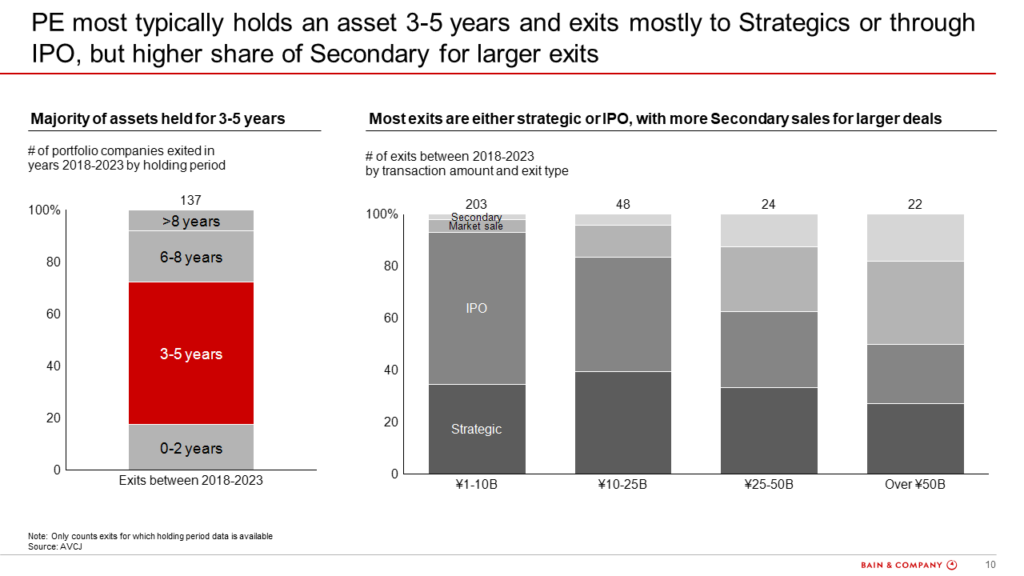

Private equity firms in Japan include both domestic firms and Japanese offices of international firms; the latter tend to focus on the larger deal size categories. Companies they acquire are on average held for 4-5 years, before being exited, typically through a sale to a strategic party or through an IPO, with secondary sales more present in recent years.

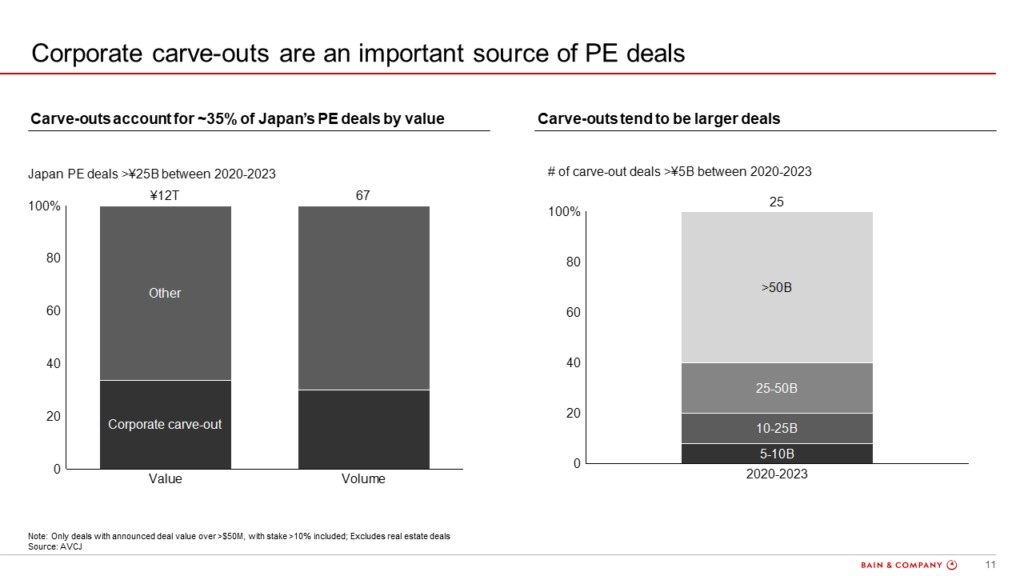

Key current deal trends are corporate carve-outs (particularly for larger deals), take privates, owner/founder successions (typically for small to mid-size deals), and growth equity investments in late-stage start-ups.

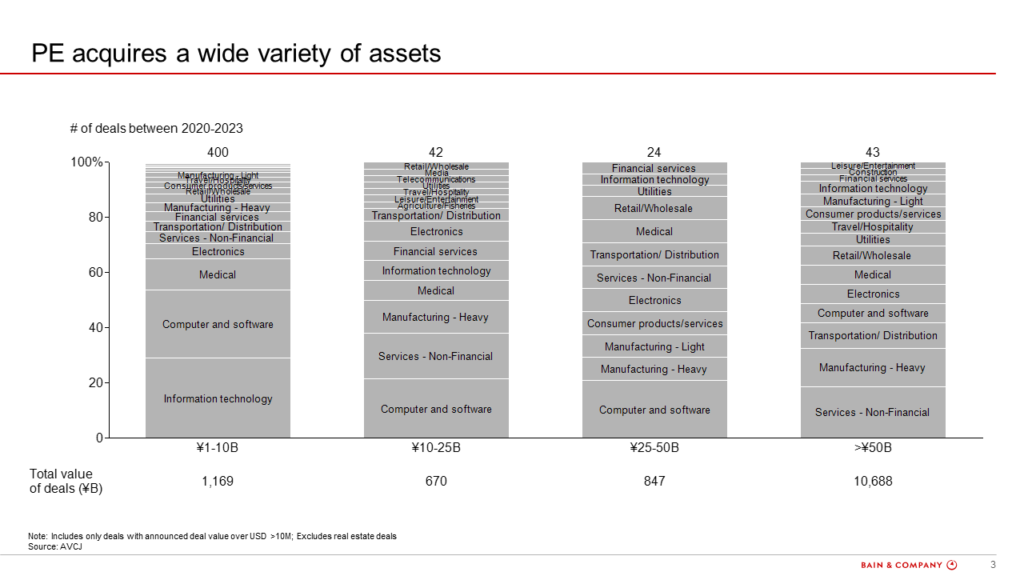

The Japanese PE market is not particularly skewed towards any specific industry, although a significant share of smaller deals is in industries with stronger growth (e.g., IT, computer and software, etc.) and larger deals show a larger presence of Services, Software and Manufacturing industries.

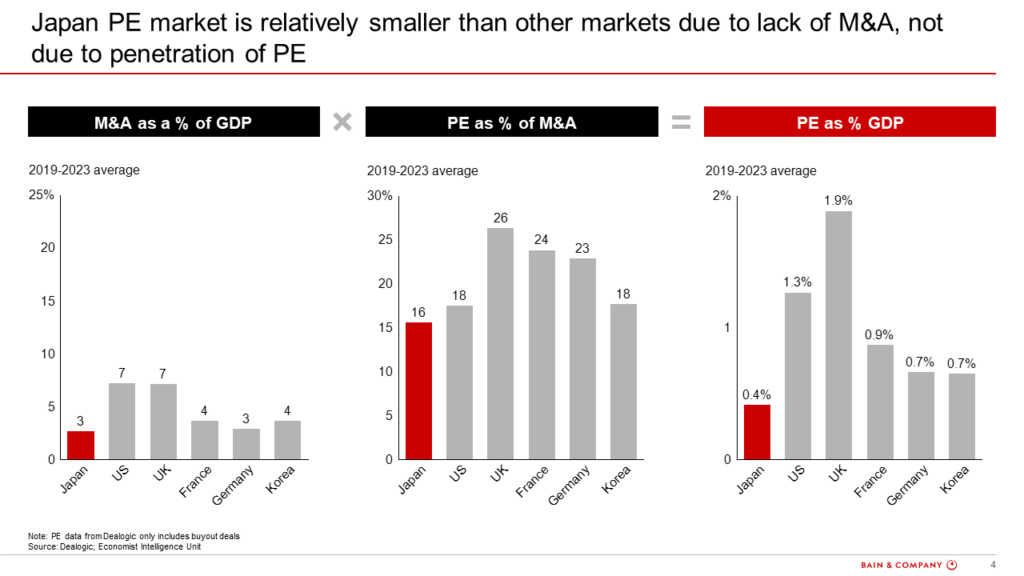

Market size and growth in international context

The Japanese PE market is small relative to other developed markets: as a % of GDP, the market is 2-3 times smaller than e.g., the German or US PE markets respectively. This is driven partially by a lower share of PE among M&A deals, but mostly by more M&A deals happening in these other markets.

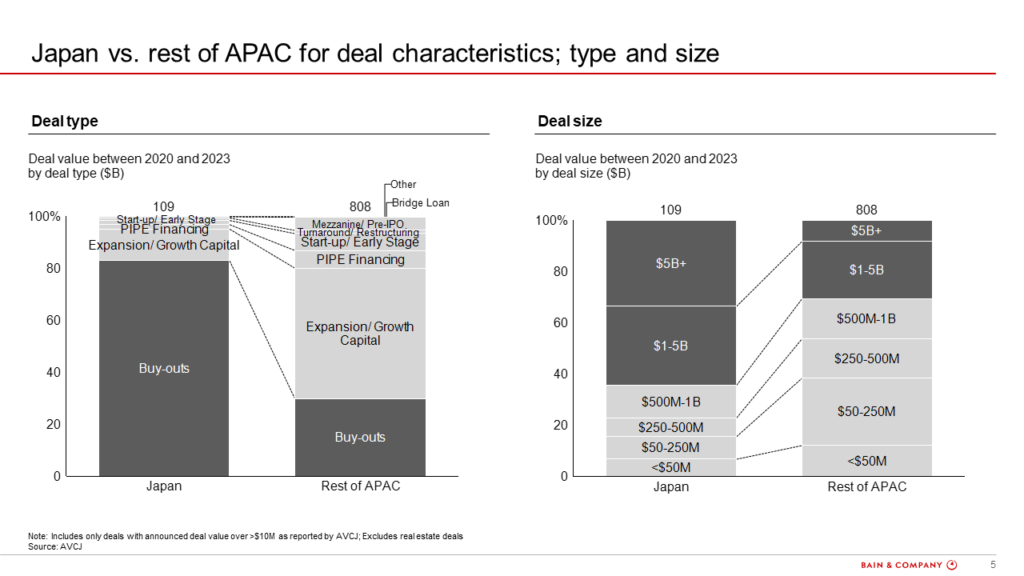

Compared to other Asian markets, the Japanese market

- Is more skewed towards buy-outs and other types of control deals: approx. 80% of deals in Japan were buy-outs vs. ~ 30% in rest of Asia-Pacific

- Has a greater share of larger deals: deals over $1B account for approx. 65% of total deal value in Japan, and 30% in rest of Asia-Pacific

While the Japanese PE market represents a smaller share of the overall Asia Pacific deal market, when focusing on larger buy-outs (over $250M), Japan has risen to become the 2nd largest market in Asia Pacific.

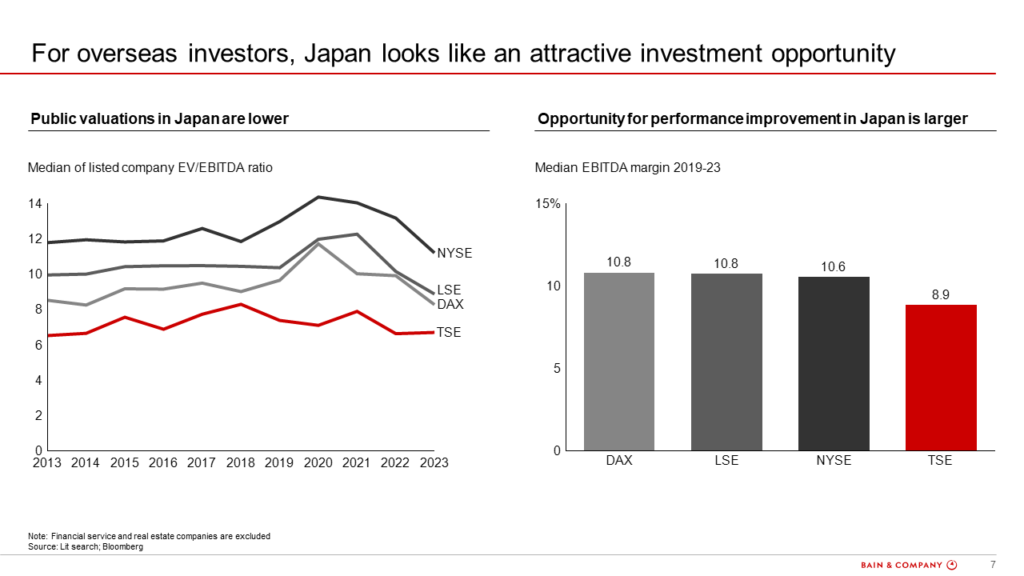

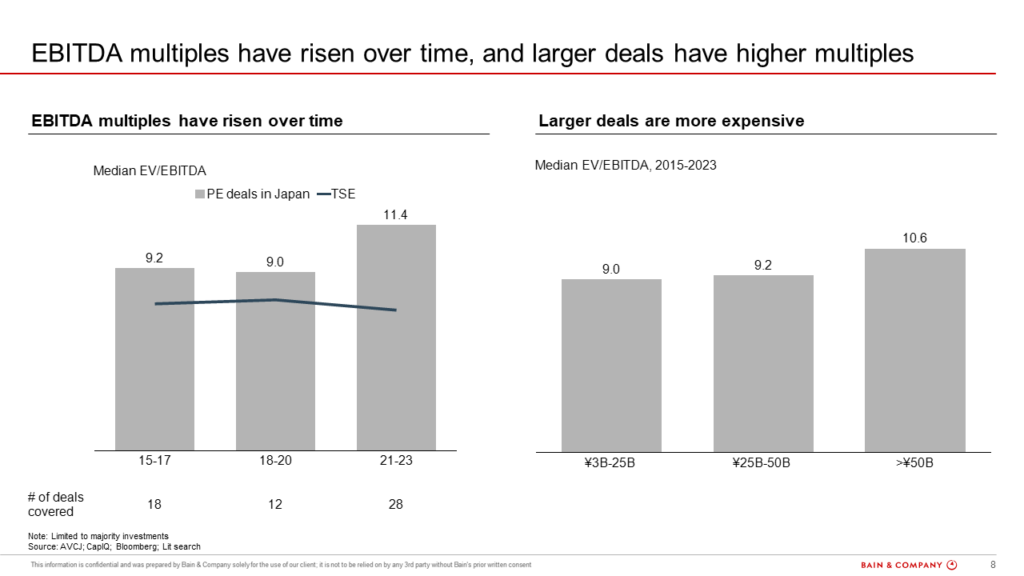

However, entry valuations of PE investments in Japan are not as low as the public market comparison would suggest: they are significantly above public EBITDA multiples. Private equity is able to pay such higher valuations as it expects to make companies more valuable through operating or strategic changes. Transaction multiple paid for larger deals tends to be higher, reflecting the quality of business and competitive auction process typically conducted for the larger deals.

Participants in the Japanese PE market

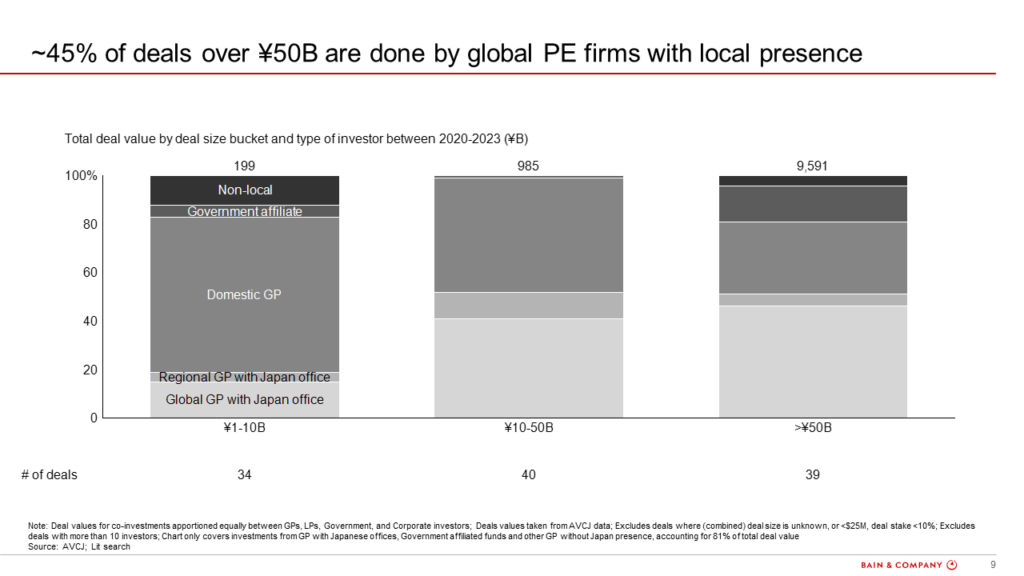

Most deals in the Japanese PE market are done by firms with a local, on-the-ground presence. These can be either domestic Japanese firms, regional PE firms, or global PE firms. The size of deals pursued by a PE firm is often a measure of the size of their funds: a domestic firm with a smaller fund will pursue smaller deals than an international firm with a large Asia-focused or global fund. As the fund size of Japanese PE firms is expanding, some Japanese firms are also participating in larger size deals.

Holding period and exit

PE firms make money for the investors in their funds ultimately by exiting their investments at a profit. The average holding period for PE investments exited between 2018-2023 was ~4.5 years. It would be rare to see periods shorter than 2 years or longer than 9-10 years. When PE firms exit an investment, the routes can be various. Most typical is a sale to a strategic investor, followed by an IPO. In a minority of situations, PE firms sell an asset to another PE investor in a secondary transaction.

Key deal trends

As the PE industry in Japan has been around for over two decades now, the general understanding of and acceptance of PE has increased significantly. This impacts three main trends that can be observed in deals pursued by PE firms, and that are expected to provide continued momentum for the industry going forward.

Corporate carve-outs

Corporate carve-outs are supported by the call for greater focus on return on equity by the government, which it tries to achieve by enhancing corporate governance. Japanese corporations often have a less focused portfolio than their global counterparts, which limits their ability to invest sufficiently into all their businesses. As a result, certain businesses have the potential to flourish more under independent management than they would as part of their current parent company.

Corporate carve-outs are especially relevant for the larger deal segment. With the continued improvements in governance and transparency, the momentum behind such divestitures can be expected to continue.

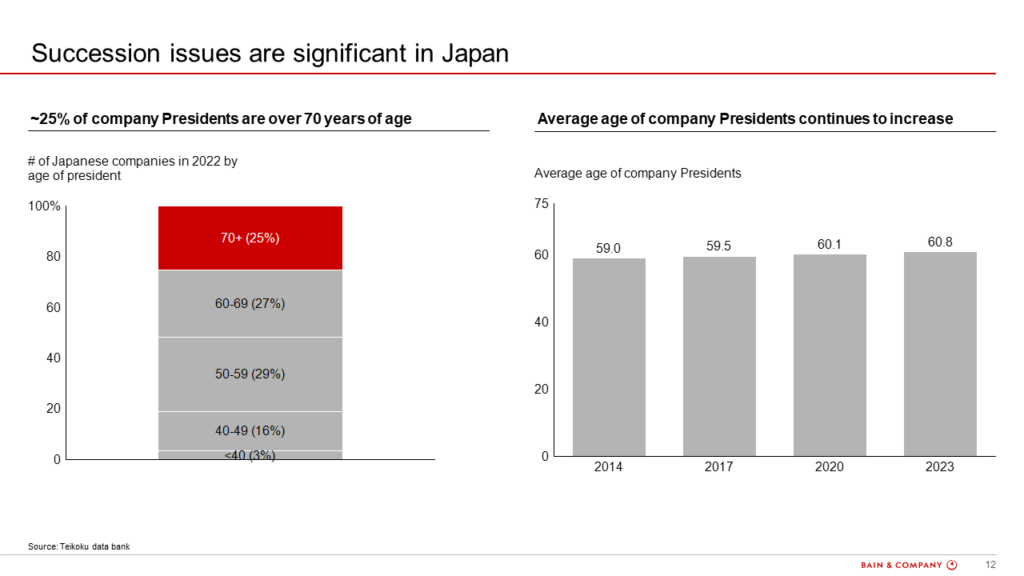

Owner/founder successions

Owner/founder successions are another important potential source of deals. Many owners or founders are aging and retiring, and do not always have a successor in place. In such instances, PE has an opportunity to support the succession by transitioning management to professional management, while bringing in fresh capital enabling the owner/founder to monetize the wealth locked up in the company. The opportunity in Japan is significant – many companies have aging Presidents, with over 25% of Presidents over the age of 70.

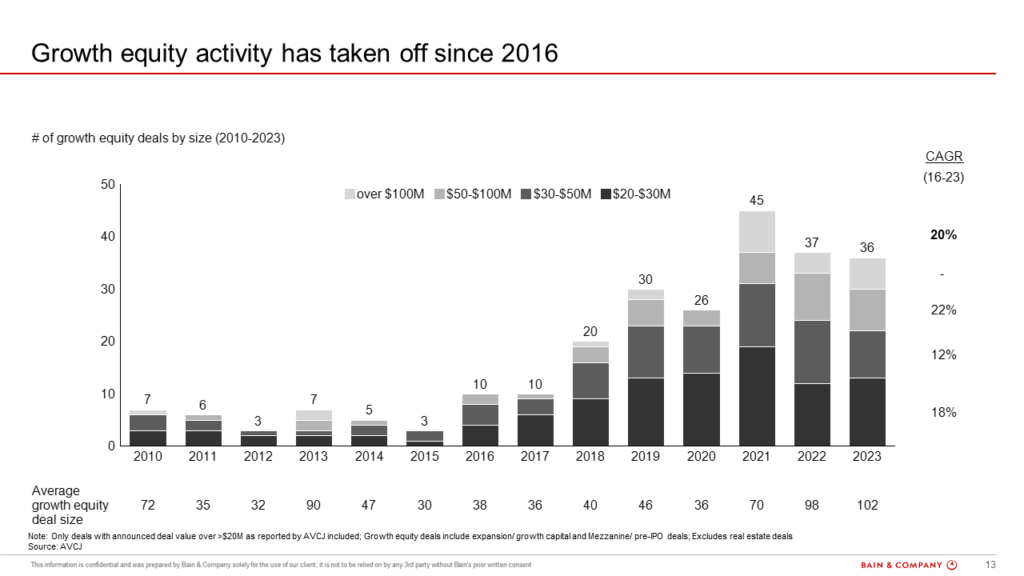

Growth equity

Growth equity investments are new equity investments made typically into late stage start-ups. Historically, start-ups attempted to IPO when they reached a valuation of a few hundred million dollars (or even earlier). More recently start-ups are delaying their IPO by getting additional rounds of private funding in the range of $20-100M. This can offer the start-up a bigger IPO and a delay of quarterly scrutiny by public market investors. With the start-up scene in Japan having become more active since the late 2000s, this is now delivering a greater flow of start-ups that are mature enough and sizeable enough to require this level of funding.

This article was prepared by Bain & Company Japan, Inc. For more information, see https://www.bain.com/industry-expertise/private-equity/