HarbourVest is an independent, global private markets firm with 40 years of experience and more than $92 billion of assets under management as of December 31, 2021. Our interwoven platform provides clients access to global primary funds, secondary transactions, direct co-investments, real assets and infrastructure, and private credit. Our strengths extend across strategies, enabled by our team of more than 800 employees, including more than 175 investment professionals across Asia, Europe, and the Americas. Across our private markets platform, our team has committed more than $49 billion to newly-formed funds, completed over $40 billion in secondary purchases, and invested over $27 billion in directly operating companies. We partner strategically and plan our offerings innovatively to provide our clients with access, insight, and global opportunities.

目次

- 1) Japan is an Important Private Equity Market for the Asia Pacific Region

- 2) Accessing Japan Through Private Equity Provides a More Balanced Exposure

- 3) Japan Private Equity has the Potential to Generate Attractive Returns

- 4) Japan Private Equity Momentum is Growing

- 5) Investors are Increasingly Focused on Evaluating Risks

- 6) Looking Forward

- Author profile Hemal Mirani Managing Director

1) Japan is an Important Private Equity Market for the Asia Pacific Region

As the world’s third largest economy delivering $5 trillion in GDP, Japan is undoubtably a global economic powerhouse. ¹While private equity investing in Japan is still developing, with private equity investments as a percentage of GDP at approximately 0.2%, compared to over 2% in the US, Japan continues to be a consistent source of investment opportunities in Asia Pacific. ²Japan makes up on average 11% per annum of the region’s total investment activity in the last 10 years, reaching $18 billion in 2021. ³There are several drivers behind this growth including the government’s introduction of the Stewardship Code in 2012 (most recently amended in 2020), deepening of the local leverage market and more notably, continued maturation of many domestic private equity managers. The latter being particularly important for global institutional investors as they contemplate building a more targeted exposure for Japan amid a macro landscape of growing risk and uncertainty. As investors look toward upcoming fundraises by Japanese managers, many will focus on traditional metrics such as historical performance or evolution of strategy, but increasingly value creation in Japan is linked to core operational strength, including a firm’s commitment to team development, business leader succession planning, and the level of fund management expertise. As the Japanese market continues to evolve, there will continue to be pressure on local managers to keep pace in institutionalizing their platforms to match many of the best practices seen in other developed markets globally.

¹Nominal GDP for 2020. Source per World Bank data as of June 10, 2022.

²Average over five years (2015 to 2019). Source per Preqin Markets in Focus: Private Equity & Venture Capital in Japan’s Transitioning Economy (November 2020).

³Last 10 years (2012-2021). Includes private equity & venture capital. Excludes investments by sovereign wealth funds and other non-PE financial investors. Source per AVCJ and HarbourVest analysis.

2) Accessing Japan Through Private Equity Provides a More Balanced Exposure

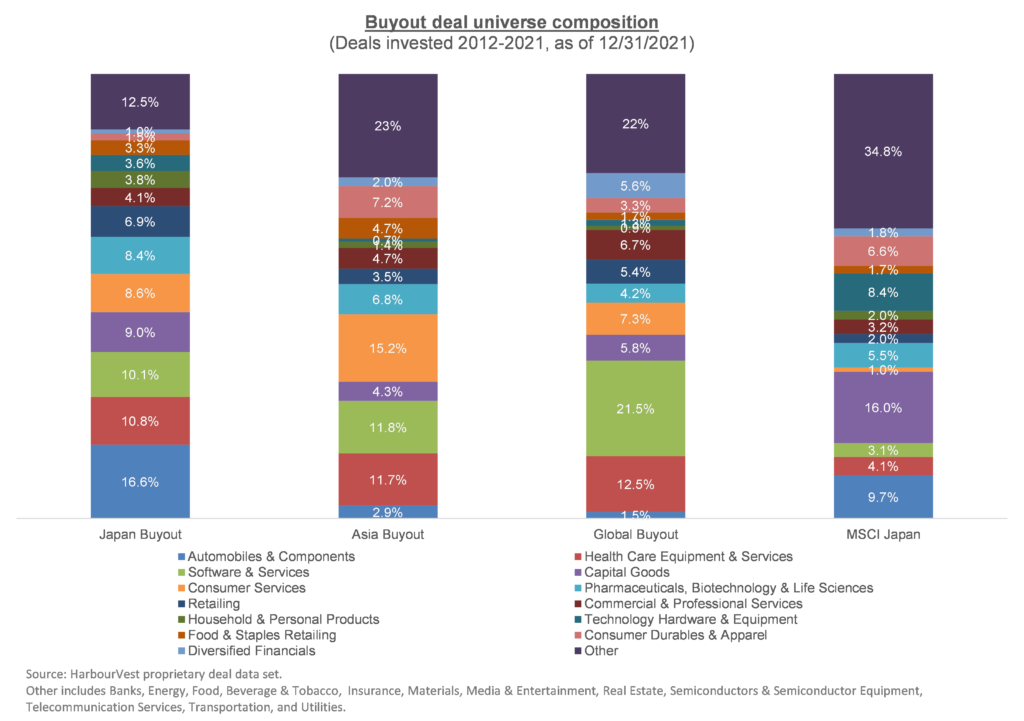

Japan is a unique and dynamic market with a variety of investment archetypes including large corporate carve-outs, medium and small founder succession deals, turnaround and restructuring opportunities, and a budding venture ecosystem. In terms of strategy, Japan predominately offers buyout and other control type investment opportunities. From a sector exposure standpoint, accessing Japan through private equity (buyout; excluding venture) can provide a more balanced exposure to the country as illustrated in the chart below. Comparatively, the MSCI Japan index shows a tilt towards businesses in capital goods (ex., construction, industrial machinery, and general trading businesses).

3) Japan Private Equity has the Potential to Generate Attractive Returns

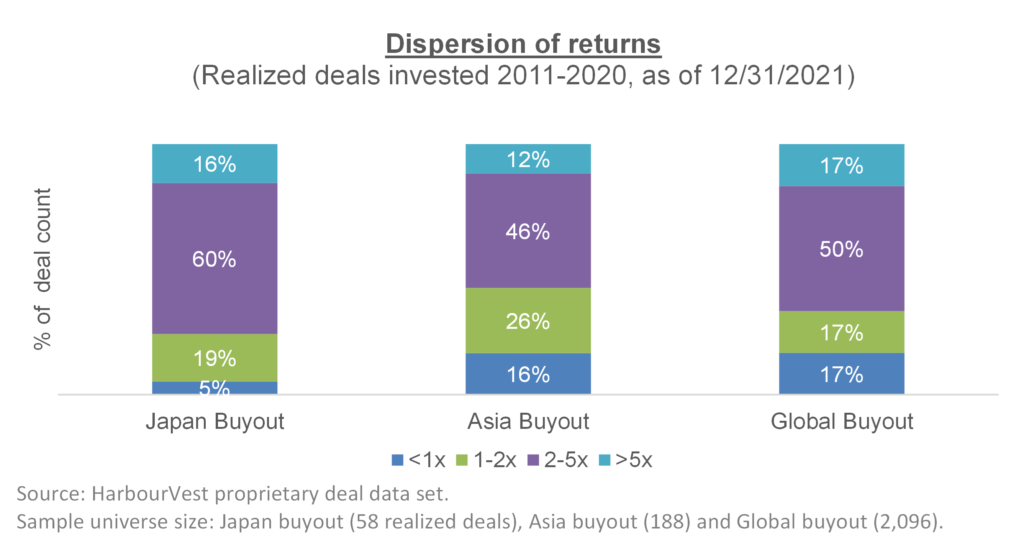

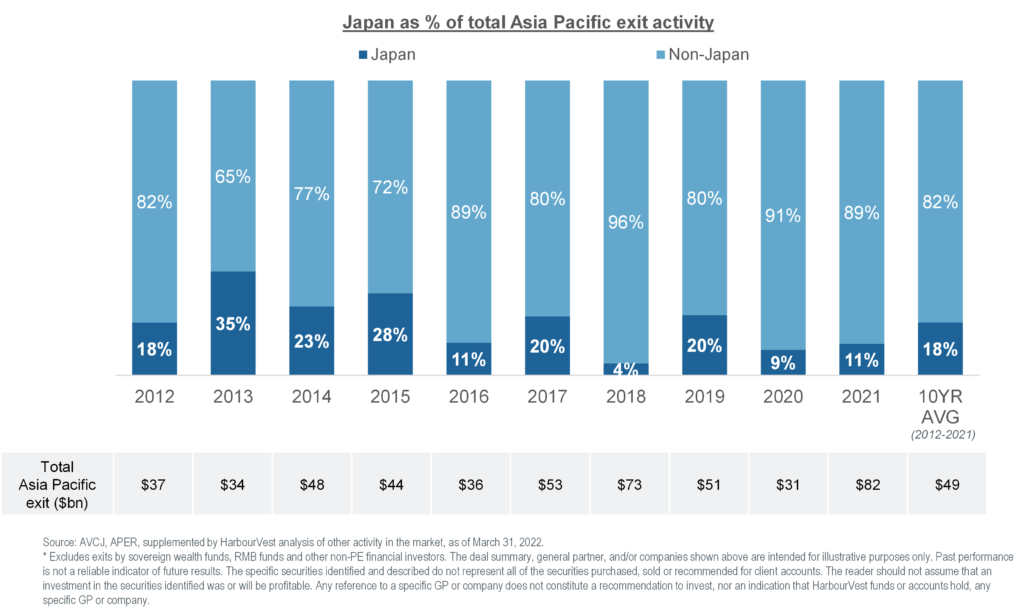

Beyond portfolio diversification, Japan has the potential to deliver attractive returns to investors. Looking at realized deals between 2011-2020, the data suggests Japan has generated relatively lower loss ratios (i.e., deals exited at below 1.0x TV/TC) than rest of Asia and global buyouts while maintaining similar level of outperforming deals (i.e., deals exited at above 5.0x TV/TC). We have observed Japanese managers creating long-lasting value in their portfolio companies. Their hands-on engagement in professionalizing companies and establishing strong governance and processes have spurred a renewed growth momentum that appeals to both the IPO market and prospective trade buyers. Japan has on average generated over $8 billion in exits per annum, contributing on average 18% to Asia Pacific’s annual exit in the last 10 years (2012-2021).⁴ Availability of attractive leverage is also a key hallmark of many deals, giving managers another important tool to generate investment returns. Generally speaking, the use of leverage is still in its nascency across Asia Pacific, but we see this as an attractive and differentiating factor for Japan.

⁴Includes private equity & venture capital. Excludes exits by sovereign wealth funds and other non-PE financial investors. Source per AVCJ and HarbourVest analysis.

4) Japan Private Equity Momentum is Growing

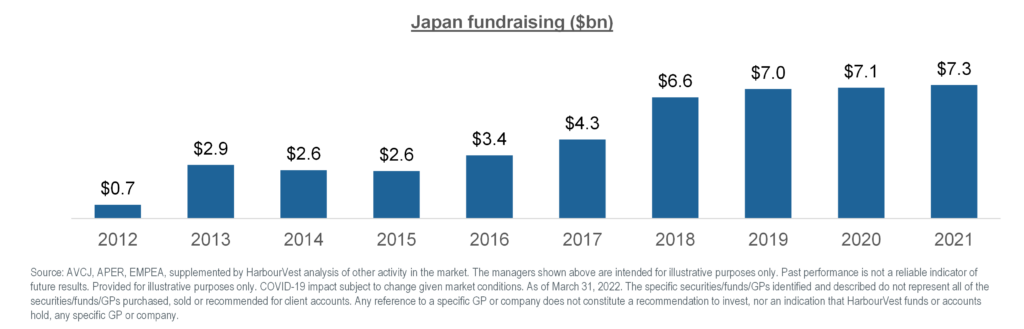

HarbourVest has been investing in Japan since 1992. We have seen managers maneuver various economic cycles and while there has been a certain level of consolidation over time, fundraising has grown overall. Japanese managers raised on average approximately $6.5 billion per annum between 2017 and 2021, an increase of 162% from the prior 5-year cycle (2012 to 2016). Growth has largely been driven by both larger fund sizes, as well as the emergence of new local managers. Further propelling the industry is the growing local acceptance of private equity firms as buyers of businesses, and as a sought-after career choice for young Japanese professionals. Perhaps most notably, the speed and magnitude at which the market has flourished is largely attributable to Japanese limited partners that are providing domestic funding for new fund managers to establish themselves without relying solely on foreign capital.。

⁵Includes Japan country funds (private equity & venture capital) only and excludes pan-regional funds. Source per AVCJ and HarbourVest analysis.

5) Investors are Increasingly Focused on Evaluating Risks

That said, given where we are in the global economic cycle, investors’ mindsets are increasingly focused on risks – from a manager’s team stability to fund size scaling concerns to its ability to create value and exit in a recessionary environment. Overlaying this with potential valuation, currency, and macro risks, naturally there is scrutiny around return expectation, particularly net returns. The concept of fund management has been embraced differently by managers but from the standpoint of institutional investors, this is an important measurement of capital efficiency and is often a distinction between a good and a strong fund manager. There are many ways for a manager to improve its fund management from utilizing a credit facility to manage capital calls to proactively recycling to reach a high invested ratio for the fund. Sometimes managers over-reserve for follow-on capital and start their new fundraise prematurely, often raising a larger fund size. This raise concerns around investment pacing and the manager’s ability to fully deploy a fund.

6) Looking Forward

As we plan for the upcoming macro-economic cycle, we believe the last 10 years have set a strong foundation for the industry in Japan where we have seen all aspects of the private markets ecosystem develop in scale and depth. With more investment opportunities, exits and quality managers to select from, we believe Japan private equity has the potential to deliver far more than just diversification in a global portfolio but generate compelling performances for foreign institutional investors.

Author profile

Hemal Mirani

Managing Director

Hemal Mirani

Managing Director

Hemal Mirani rejoined HarbourVest’s senior management team in Asia in 2015 to focus on investments and investor relations across the Asia Pacific region.

Hemal first joined HarbourVest in 1997 and spent eleven years developing relationships with leading Asian private equity managers and working with our investors and consultants across the region to advance and optimize their private market investment programs. She rejoined HarbourVest after six years with CVC Capital Partners in Hong Kong, where she was head of investor relations in Asia and Chief Administrative Officer.

Hemal received a BA in Commerce from Sydenham College (Bombay) in 1989, an MA in International Studies with a Japanese language concentration from the Joseph H. Lauder Institute, and an MBA in Finance from the Wharton School in 1997. The latter two were part of a joint degree program at the University of Pennsylvania. Hemal speaks fluent Japanese.